Market reference identifiers, such as 919440217, 120907860, 1140402377, 955254200, 8556484250, and 8006001340, serve a crucial function in the financial sector. These identifiers streamline transactions and enhance data accuracy. Their role extends to improving regulatory adherence and guiding stakeholders in decision-making. However, the implications of these identifiers go beyond mere efficiency. Understanding their individual significance can reveal deeper insights into the complexities of financial operations. What might these insights entail?

Understanding Market Reference Identifiers

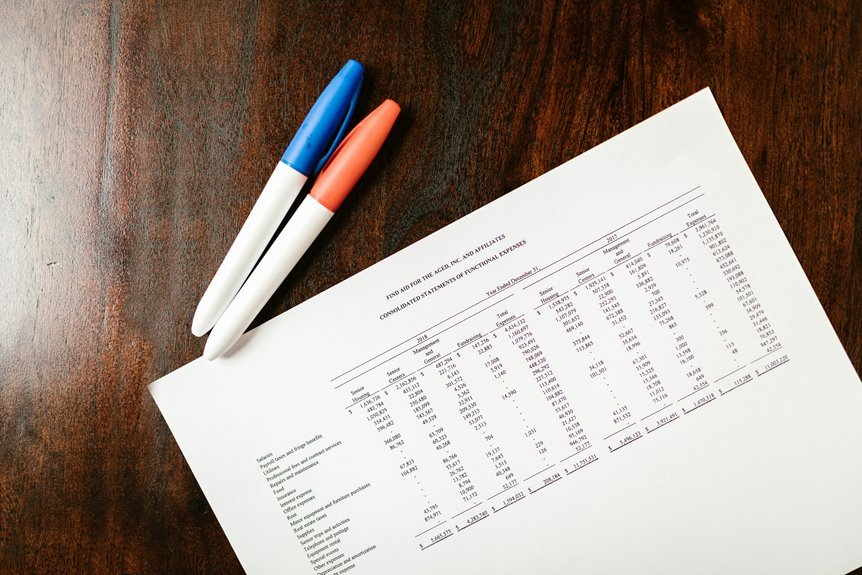

Market reference identifiers serve as essential tools in the financial sector, facilitating the accurate categorization and identification of various securities and assets.

These market identifiers not only streamline trading processes but also enhance the analysis of market trends. By leveraging standardized identifiers, stakeholders can effectively track performance, assess liquidity, and navigate the complexities of financial markets, thereby promoting informed decision-making.

Significance of 919440217

Although often overlooked, the identifier 919440217 plays a crucial role in the realm of financial transactions and reporting.

Its significance analysis reveals extensive identifier applications, facilitating efficient data management and enhancing transparency.

Importance of 120907860 and 1140402377

Identifiers such as 120907860 and 1140402377 serve pivotal roles in the financial landscape, akin to the impact of 919440217 on transaction efficiency and transparency.

Their importance factors include enhancing data accuracy and facilitating regulatory compliance.

Through identifier analysis, stakeholders can ascertain potential risks and opportunities, ultimately fostering informed decision-making and promoting greater autonomy within the financial ecosystem.

Exploring 955254200, 8556484250, and 8006001340

The analysis of identifiers such as 955254200, 8556484250, and 8006001340 reveals their critical function in streamlining financial transactions and enhancing data integrity.

These identifiers are pivotal in product analysis, reflecting market trends that inform businesses about consumer behavior and preferences.

Understanding their implications allows stakeholders to make informed decisions, thereby fostering an environment conducive to economic freedom and innovation.

Conclusion

In conclusion, market reference identifiers serve as the backbone of financial transactions, akin to the roots of a tree that nourish and stabilize its structure. The specific identifiers discussed—919440217, 120907860, 1140402377, 955254200, 8556484250, and 8006001340—underscore the critical role these tools play in ensuring efficiency, compliance, and transparency within the financial ecosystem. Their significance is paramount, as they facilitate informed decision-making and enhance the integrity of market operations.